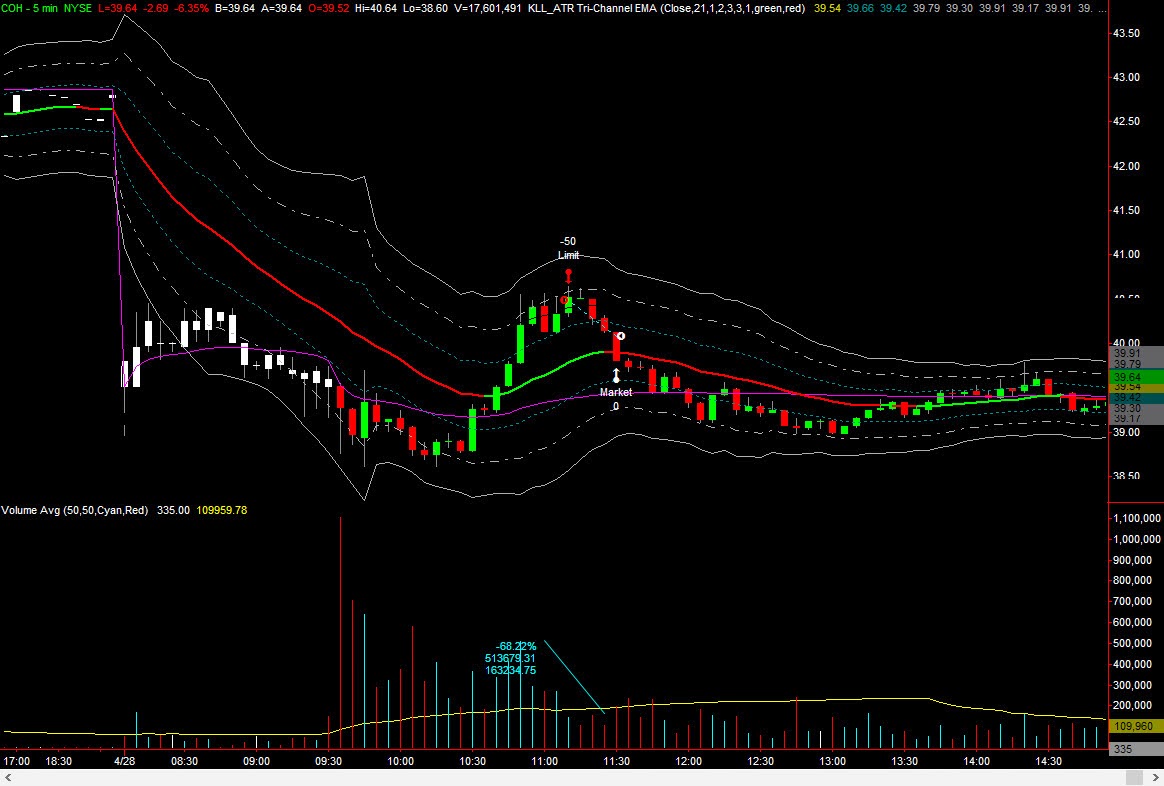

Very jumpy day with futures opening down or flat and no trend for the morning

Trading

A total stuff up today, feel like I just went back a few years as I broke every rule in the first few trades.

I got in for no good reason

I chased

I got annoyed and tried to get back

I fought the trend of the stock and market

Last trade of the day I followed the rules

Stops in place

Stock in downtrend with no upside moves

Action on the tape to confirm entry

Out on time stop near close

Entered on limit near VWAP

Rules

Dont trade long any stock that opens below yesterdays close

Dont trade short any stock that opens above yesterdays close

Use hard stops and dont move them up

Take part profits

Dont add till levels are busted high or low

Needs to be a driver for a trade

Needs above avg volume

Wait for test of true levels not intermediate noise (Some stocks in normal behavior will drop only part way on the first move down for the day. Stocks in play tend to get driven down from this mid-level and so are being played with by market makers of HFT and so will have a very good chance of a rebound)

This will do for a start

Daily PL

AAPL

Put in limit order in what appeared to be near the prior washout low on open

Did not put in Stop as an OCO as I put in the wrong order type

Got fill as it was plummeting down and way past mental stop level.

Stock hesitated so put in stop down further but did not check longer term levels so was out by around 20 cents

Got stopped out

BBBY

Fought trend, stock stalled just around day high and thought it would not drop from there so put in limit order long with stalled stock on bad earnings report with jumpy market and some weakness in all futures. What else did I get wrong, thats right I also chased it down with orders long just for fun.

A heap of errors for no good reason. Micro managing trades and not looking at big picture for some sense and waiting for conformation

PIR

Got this right

Waited for conformation on tape of selling pressure on tape near VWAP

Held for a while till near session close

Took small profit

Trade never looked in doubt

Had stop in place