Good day, only two trades on a flat market day and refused to get sucking into trading and losing out of impatience and being too clever

A massive $20 and feel rather good about this as it was earned and better yet it was retained

IWM

The one that got away. I like trading this index, it seems to move a bit and falls to a mid level a lot of the time with clear action on the tape and then a fall to support. I am getting more patient with entries but as you can see not so patient with holding. Too many small losses over time and I am jumpy.

This is one area that will make a massive difference to my trading and so working on scaling out with set OSO orders so I can close my eyes and let it happen.

Goal is to take a small profit at the first move up and then hold.

I will get stopped out a bit but that happens anyway so need to endure this and keep at it

I took around 25cents and left the next dollar

MU

Good trade, it fell, corrected and stalled after a small spike up.

Entry was limit and 1 cent less than market so an easy quick fill

Out on bounce at bottom

I was tempted to sell short again but decided not to as it was a stupid idea. The stock was tracking along sideways and no movement so as best it would be a painful boring trade without clear direction

Tuesday, June 16, 2015

Thursday, June 11, 2015

11/06/21015

Felt good today after a break and a fresh set of eyes to look through. I made two basic mistakes today that need fixing as they are bad habits but also a couple of good trades.

PL for day was a negative but very small losses

Bad today

Weak stock selection

Fighting the trend with a short in IWM on a trending day

Good today

Traded SPY long with the trend and off a higher support level rather that waiting for a big washout

Stops saved bigger drawdowns

Cut a trade that was not working

Small losses

Use of limit sell to take profit when away from the screens (asleep)

PL

LULU

Bad trade

In to soon and wrong level

Could have worked with some more patience with entries around 1 or 2. The stock has settled a bit the trade would have been a lot cleaner. I got annoyed with this one and made a second trade to soon after the first and was stopped out a second time

Small losses just annoying and not very good trading

WETF

Long and made a mistake on the drive for this one. It was mixed in with another stock in a news item and so I got it wrong.

This traded in a sideways range all day, I had three opportunities to get out with small profit and it was stalling at 23 with a big seller.

Smart trade would have been to sell just under 23 and get back in if it broke and showed support.

PL for day was a negative but very small losses

Bad today

Weak stock selection

Fighting the trend with a short in IWM on a trending day

Good today

Traded SPY long with the trend and off a higher support level rather that waiting for a big washout

Stops saved bigger drawdowns

Cut a trade that was not working

Small losses

Use of limit sell to take profit when away from the screens (asleep)

PL

IWM

Dont fight the trend

Short on stall but not a level for entry

I cut this trade when it moved off the prior high so happy with the exit

All indexes were strong

Short was not the right trade today

LULU

Bad trade

In to soon and wrong level

Could have worked with some more patience with entries around 1 or 2. The stock has settled a bit the trade would have been a lot cleaner. I got annoyed with this one and made a second trade to soon after the first and was stopped out a second time

Small losses just annoying and not very good trading

SPY

Good trade

Entry after about 20 minutes of sideways action and stop was about 3 cents from getting smacked at one point

Went to sleep and put in a limit sell just below day high and this got taken

Nice clean simple trade

WETF

Long and made a mistake on the drive for this one. It was mixed in with another stock in a news item and so I got it wrong.

This traded in a sideways range all day, I had three opportunities to get out with small profit and it was stalling at 23 with a big seller.

Smart trade would have been to sell just under 23 and get back in if it broke and showed support.

Friday, May 22, 2015

22/5/2015

Another frustrating day. A few stops hit and some profits not taken on smaller gains.

I am not posting all the charts today as there are a few of them and they dont show much of use.

Stock selection seemed ok to start with but then I found reasons to trade on some and they either did not work or I cut them short to save bigger losses.

I entered two stocks twice and this did not produce.

Bad today

Frustrated and did not find good setups.

Trading low probability stocks as the market was for most of the day but did pick up towards the end.

Stayed up for full session and felt like I should be doing something

Good today

Cut some losers fast for small gains

I had two stocks in profit but held them when they tested a level and then never re-tested so got stopped out or cut the trade. I need to hold longer and this will lead to some small winners ending up as losing trades

One good trade suggested by William and followed through with this one for profit VIPS. Traded this short then long

Roll on tomorrow, have another go.

I am not posting all the charts today as there are a few of them and they dont show much of use.

Stock selection seemed ok to start with but then I found reasons to trade on some and they either did not work or I cut them short to save bigger losses.

I entered two stocks twice and this did not produce.

Bad today

Frustrated and did not find good setups.

Trading low probability stocks as the market was for most of the day but did pick up towards the end.

Stayed up for full session and felt like I should be doing something

Good today

Cut some losers fast for small gains

I had two stocks in profit but held them when they tested a level and then never re-tested so got stopped out or cut the trade. I need to hold longer and this will lead to some small winners ending up as losing trades

One good trade suggested by William and followed through with this one for profit VIPS. Traded this short then long

Roll on tomorrow, have another go.

Thursday, May 21, 2015

21/5/2015

Interesting day with tiny loss and a good trade that got away

PL

IWM - long. Missed the main fall to support in the morning and took this one near close. A good trade but no upside. Would do this again. IWM has a habit of one good wipeout a day off support and always a second level down so one to watch and understand

TGT-long. Traded off Support after a higher high but not a new overall day high.

In checking there was no reason to trade this one, it was not in play and a weak follow on from some strong retail sector stocks yesterday

A mistake as I did not check this correctly

PL

QQQ - long. Traded near end of day off support. Good trade but no movement. Would do this again

PBMD - long. This was good setup with all the ducks in order. I entered with some confidence and then seen two very good SMB traders go short. After it stalled a little I then sold.

This would have a very good trade and now need to work on some way to ignore other traders if I think a trade has merit. Some form of checklist to let me know the stock is still in play and my thesis is supported by some facts and I can then hold

IWM - long. Missed the main fall to support in the morning and took this one near close. A good trade but no upside. Would do this again. IWM has a habit of one good wipeout a day off support and always a second level down so one to watch and understand

TGT-long. Traded off Support after a higher high but not a new overall day high.

In checking there was no reason to trade this one, it was not in play and a weak follow on from some strong retail sector stocks yesterday

A mistake as I did not check this correctly

Tuesday, May 19, 2015

20/05/2015

Good day, small profit and pretty happy. Any day that is based on nice clean trades is a good one.

TTWO Long - Stock looked strong with pre market up above post market levels and a good drive up on open. It seemed to be holding so I entered on a small move above the prior range.

I held for around 40 minutes and got out when it stalled.

This was a nice clean trade and one I would not normally take. I struggle to buy the new highs and need to put more effort into finding these sort of stocks that are moving for good reason

CSX - Long Entered on a move about 36 but it failed to hold. happy enough with the trade and in hindsight I should have waited for a re-test of the 36 from above. There was no support at that level and it failed

TJX - Long Strong stock in its sector and posted good earnings along with strong outlook. this put it ahead of some other retailers and gave it a good open. I entered on a test of the open low and it held with some upside. When it stalled and I got out. A bit gun shy and have struggled for winning trades lately so was good to get out after a nice spike up.

TTWO Long - Stock looked strong with pre market up above post market levels and a good drive up on open. It seemed to be holding so I entered on a small move above the prior range.

I held for around 40 minutes and got out when it stalled.

This was a nice clean trade and one I would not normally take. I struggle to buy the new highs and need to put more effort into finding these sort of stocks that are moving for good reason

CSX - Long Entered on a move about 36 but it failed to hold. happy enough with the trade and in hindsight I should have waited for a re-test of the 36 from above. There was no support at that level and it failed

TJX - Long Strong stock in its sector and posted good earnings along with strong outlook. this put it ahead of some other retailers and gave it a good open. I entered on a test of the open low and it held with some upside. When it stalled and I got out. A bit gun shy and have struggled for winning trades lately so was good to get out after a nice spike up.

Wednesday, May 13, 2015

14/5/2015

Another maddening day, stopped out of two trades that should have worked and this just annoys me no end.

The two other trades that lost were ok, one just did not work and one was a very well managed loser so happy there

No serious losses but so frustrated on these stop outs.

PL

KO Tried to short this near the close. It had fallen and looked to be in a gentle slide down. Trade did not work so took half off and then closed well below stops. A well managed trade that did not work. No issues with this one

The two other trades that lost were ok, one just did not work and one was a very well managed loser so happy there

No serious losses but so frustrated on these stop outs.

PL

VZ - Long and stopped out, LoD around 6 cents beneath stop.

This was not a world beater but there was a good 20 - 25 cents in this trade. I have been caught like this a lot as it seems with the tight range after the open drive and correction there are stops building up under the range.

The correct way to trade would be to place a limit buy around the lows of the prior day and the same stop of 14 cents but it would be down another level.

This would produce a cleaner trade with more chance of working

M

Another annoying trade. Not sure what to do in this case. Stopped out by a cent and then it runs up just over a dollar. Again it should have been expected after the tight range but it is not so clear on this chart where the stop should have been but a wash out of stops should have been expected with the sideways action.

ESV tried a short but should have waited for a test of the low as it just kept moving up and got stopped out. Not a good trade and no anguish on this one as it just did not work

13/05/2015

struggled to find trades today.

Two trades with a very small loss for the day

Still will not trade any size until I get consistent winning days and use good trade management. Its is very frustrating but that is the goal I have set and will stick with it

I did not overtrade today and spent a lot of time looking at stocks and also put both stocks into my pre trade planner. This is a good way to settle me so I dont trade all the stocks that look good.

The trade management was good, I gave away nothing and exited trades by choice instead of waiting to see if the stops would be hit.

ZU

Entered trade with support after about 30 minutes of market time. I did have around 20 cents profit but decided to see if it would run some more. In the past I have exited trades far to early and so intend to hold longer. This will give some losses but should capture the stocks that run.

I took of half the position when it failed to move up again and was making a lower low

I cut the rest of the trade when it looked like it might break to the downside

It did end up running up around 40 cents but I was not at the screens and that was also a reason to cut the trade as I was not there to manage the position

PTE

This stock moved up fast on open and spent the rest of the day drifting down to support. I entered on a higher high of the LoDay and held while it tested this low a second time. The stock did not move and looked dead going into the close so got out my fees and was out.

Thursday, April 30, 2015

30/04/2015

Crazy day, stocks overacting to any bump in the road and not respecting levels.

Check list is helping a lot at keeping me out of trades I like but are low probability and have little chance of working

Pre trade list

Looked at lots of stocks that opened flat or low but no decent setups so only small size and few trades

Check list is helping a lot at keeping me out of trades I like but are low probability and have little chance of working

Pre trade list

Looked at lots of stocks that opened flat or low but no decent setups so only small size and few trades

Profit today and happy for any upside. A few more days and will increase size so any up day is a good day

IWM

This index move fast and over reacts to events.

Entered on support and held till it stalled. I sold half the position and then put in a stop at break even and just left it to do what it wanted

OCR

This was up on good 1stQ yesterday and a take over rumor This caused a big upside and with a lower open and high today and no conformation of the take over its a good fundamental for a breakdown.

It stated to work and then held. Will look at this again tomorrow as each day will wear it down some more

BRCM

Held well at support and level on longer term chart

Entered and when it failed to move cut the position.

Got out with fees so happy

29/04/2015

Jumpy day full of opportunities and happy to watch others trade them.

I made 2 trades and ended up with profit and the plan is to keep trading with small size until I get a run of 6 of 10 days in profit and a success rate of 60% in profitable trades. At that point I will increase avg size of each trade.

I will still take advantage of any high conviction setups that can be traded with a tight stop until them but respect a stop loss of max $50.00 on any one trade

I looked at a lot of stocks today with running constant scans during the trading hours. Only a few make it to the check list and this again saved me from over trading. When I am comfortable with the format of this list I will put together a checklist for entering trades as well.

PL

I made 2 trades and ended up with profit and the plan is to keep trading with small size until I get a run of 6 of 10 days in profit and a success rate of 60% in profitable trades. At that point I will increase avg size of each trade.

I will still take advantage of any high conviction setups that can be traded with a tight stop until them but respect a stop loss of max $50.00 on any one trade

I looked at a lot of stocks today with running constant scans during the trading hours. Only a few make it to the check list and this again saved me from over trading. When I am comfortable with the format of this list I will put together a checklist for entering trades as well.

PL

HOT

Looked to short this as there was no real driver for the increased price and it seemed to be just hype. It did hold up and I made two trades. I cut the first one when it did not move as quick as I wanted only to watch it drop a little.

I missed the next opportunity and then took the one after. It was looking to strong so exited for a small profit

KBR

A really good trade with a nice entry. Price was in a tight band on the 5 minute chart and it moved easily off this. I took half off when I left the screens and cut the rest soon after returning. There was a nice higher hold and a good move into the close.

I will watch this one tomorrow as it is very strong

Tuesday, April 28, 2015

28/04/2015

PL

I needed to stop overtrading and impluse trading so have created a pre trade check list. Its a work in progress and only takes a few minutes to fill out for each stock. So far it has stopped me trading in a few stocks that I would have normally entered and this has been good.

I use a rating system and give 1 point for each positive item and then look to the charts to see if the price, volume and levels are setting up for an entry.

For shorts I will use a -1 for each strong point

It stopped me trading F today as it was weak in most timeframes and not much to drive today apart from loyal investors.

AAPL was an impluse trade on the open and I should not have taken it at the level I entered. The expected level or price that I should have found support and did was around 40 cents below and it stopped there and then moved up nicely.

The insight for the day is that I need to trade levels supported by price and volume not get excited and see good in every micro pause in price

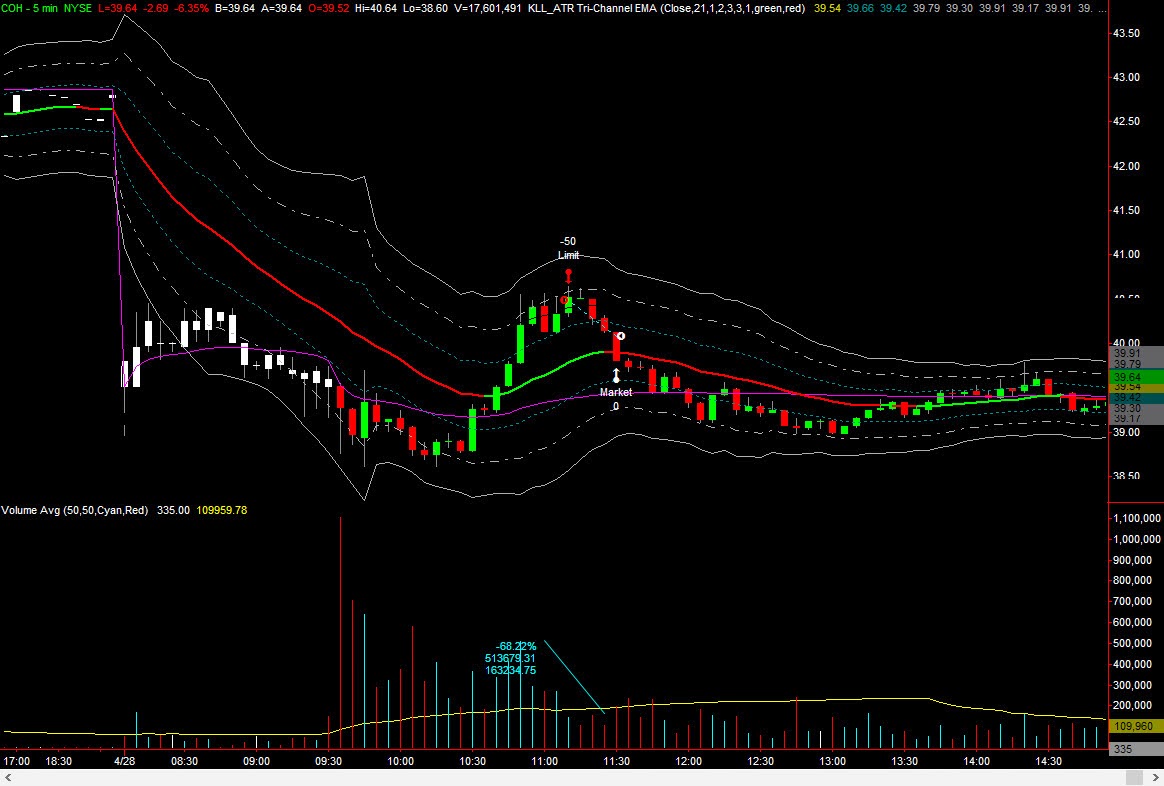

COH

Good trade, set up on the five minute chart at the open high and volume dropped away. There was a clean move down. I got out way to early and missed about double on what I got as I was annoyed at my AAPL trade and wanted to chip away at getting the money back.

MRK

This stalled at the mid pre market range and spent 10 minutes in a tight range. Volume picked up and the spread opened with bids chasing this up so entered. Got out when it stalled at a level and after the first red bar

NOV

Looking for a short and it didnt work. It did test the high and closed off this level so will be looking to short this tomorrow it shows weakness

AAPL

Got excited and traded this at the wrong level. Needed to wait for it to test a prior low

Lesson for next time

Monday, April 27, 2015

27/04/2015

Down day, using a pre-trade check list to control random trades and refining this to make a useable process so will take a few days. It did stop me from taking a couple of trades today that I would normally have traded so a good start.

market started strong but faded to lows and no upside. Tomorrow will be an interesting day and have no idea what it will so.

I will be looking for good long and short trades for tomorrow

AKRX

looked to short this but no go. News was all negative and it started out ok but did not fail from the lost of the day. The trade to take was to short the mid day move up.

Lesson, dont go long at the top of the range or go short at the bottom.

Wait for a break on volume and then the re-test

I tried two more shorts near the end of the session but cut them very quickly on volume changes on the tape

JD

Strong in principle but no go on the day.

3 trades in all but no move up

BRCM

again looked strong and was setting up but failed to move off the bottom and was rangebound.

I cut this trade due to no movement

Thursday, April 23, 2015

21-23/04/2015

Missed a few days of posts

Been very frustrating with a string of small losses. The money is not a concern but the inability to get in sync with the market is and I need to change this

My thoughts are to make small improvements in how I approach trades and to pay more attention to trends and levels.

I dont have the skill or the bank account of the SMB professionals so its best to learn from them and copy only the trades that make sense to me

PL from the last 3 days

21/04/2015 Profit and a good day. Very few stocks and clear levels also small positions and still ended positive for the day

Been very frustrating with a string of small losses. The money is not a concern but the inability to get in sync with the market is and I need to change this

My thoughts are to make small improvements in how I approach trades and to pay more attention to trends and levels.

I dont have the skill or the bank account of the SMB professionals so its best to learn from them and copy only the trades that make sense to me

PL from the last 3 days

21/04/2015 Profit and a good day. Very few stocks and clear levels also small positions and still ended positive for the day

22/04/2015 No magic today, just could not get it together. Wanted trades to work and could only see good in them but that was a disconnect from reality

23/04/2015 Too many trades and not so well managed. I take a break mid morning and need to place take profit orders on stocks. This is best done with OCO on entry and I need to keep placing these and putting in sell orders at tested levels.

One good set of trades at end of day in BRCM

BRCM

This is how I love to trade and have not done one for a while.

Stock off earnings high from yesterday

Clear downtrend for most of day

Determined seller at 45.54 on tape. Orders refreshing to around twice bid levels and ticking down a cent or two as well. Selling pressure solid when these orders were flowing

Total of 3 trades 1, 2 & 3. 200, 100, 200 lots Sold part @ 4 and closed @5 on first trade

Entered again @ 2 and sold position at 6

Seller started to keep a cap on upside so sold another 200 @ 3 and chased down with stops 2 cents above trade price. Sold at 07:55 just on close

I like trading this way and will look for more. There is potential to hold for bigger move on these or scalp 20 cent moves with some volume. Just needs decisive actions and hard stops above action on the tape

Monday, April 20, 2015

20/04/2015

all indexes green for go today. Started out strong and just keep quietly running to the upside

Stuck to the plan today with small size and following two of SSpencers picks as well.

PL + $35.56

Very happy with this, its hard using small share size as transaction fees chop into but all the trades worked and still made profit overall on each one

Charts

RCL, traded long and followed SSpencer. It gapped down a lot and I would not trade this but the plan is to man up to it and learn something new so I did that. Spread was wide and random with 30 - 50 cents and small bunches of orders at each end fighting it out.

I settled on the second red bar along the bottom range and started to form up bids and offers behaving and then moved up nicely to resistance. I exited it there had also added when it started to move off the bottom and settle

Stuck to the plan today with small size and following two of SSpencers picks as well.

PL + $35.56

Very happy with this, its hard using small share size as transaction fees chop into but all the trades worked and still made profit overall on each one

Charts

RCL, traded long and followed SSpencer. It gapped down a lot and I would not trade this but the plan is to man up to it and learn something new so I did that. Spread was wide and random with 30 - 50 cents and small bunches of orders at each end fighting it out.

I settled on the second red bar along the bottom range and started to form up bids and offers behaving and then moved up nicely to resistance. I exited it there had also added when it started to move off the bottom and settle

LVS, no real reason for this move up, earnings due later in the week and it moved up to the bottom of a gap on the daily where it had failed before. I entered and just waited, closed out at VWAP and then entered again later on. The second trade made a tiny profit and was slightly negative after fees but happy with well managed trades.

this trade is a direct result of following Steve and looking for weakness at the of a range if there is no driver and clear levels

HAL, I dont like this stock as it does whatever it wants but again copied Steve.

First short I missed the top as it moved fast so entered to low, took a tiny profit negated by fees but a good trade.

Second trade was at a higher level and after a failure to make the past day high.This broke even as as trade and was down the amount of the fees

Third trade later in the day there was a determined seller refreshing offers of around 3 -4 k and keeping the pressure on. Each time it skipped up 1 - 2 cents they would appear again and hold the up-move. Entered at market and got a fill at 1cent at the offer so happy with that and cut the trade on selling pressure drying up and bids increasing and holding

Really good trade

Subscribe to:

Comments (Atom)